STS verification

Background and objectives

It is the aim of the European Union, as part of its policy of strengthening the European credit and capital markets, to provide a secure legal framework for simple, transparent and standardised securitisations - known as STS securitisations. The creation of such a legal framework requires, on the one hand, a clear identification of such products and, on the other hand, their unambiguous differentiation from other securitisations. To this end, the legislator has defined generally applicable criteria, which are supplemented by regulatory standards and guidelines prepared by the European supervisory authorities (in particular EBA and ESMA). Although originators, sponsors and institutional investors have the primary responsibility for ensuring that compliance with the STS criteria is properly assessed and declared by the originator or sponsor, the legislator provides for the possibility of involving third parties in the verification of whether a securitisation complies with the STS requirements (see Article 27 (2) of the Securitisation Regulation). Such verification supports the originators, sponsors and investors in their evaluation and generally has a confidence-building effect on the markets. It thus creates an important, independent authority between market participants, but also with a view to the supervisory authorities, and helps to ensure proper interpretation and consistent application of the STS criteria.

Third party verification is an important contribution to the consistent, uniform and correct implementation of the new Securitisation Regulation and the STS criteria. The interaction between the third party verifier, supervisory authorities and the relevant originators and sponsors ensures that the interpretation and application of the STS criteria takes place in an appropriate and consistent manner and thus reflects the central idea of the new Securitisation Regulation, namely to tap into the great potential of securitisation as a financial instrument for the refinancing of residential property financing, SME loans, trade receivables, car financing, equipment leasing, consumer loans and other asset classes.

The STS segment had initially been open only to traditional securitisations, with the exception of certain types of synthetic SME securitisations which qualified for STS status if they fulfilled the requirements of Article 270 of the CRR. Amendments to the Securitisation Regulation in the form of Regulation (EU) 2021/557 of 31 March 2021, which became effective on 9 April 2021, have introduced the STS segment also to other types of synthetic securitisations, namely synthetic on-balance-sheet securitisations. These typically involve the securitisation of loans to small and medium-sized enterprises and large corporates, but can also include project finance loans, residential mortgages, consumer loans, auto loans and other asset classes, and are an important tool for credit institutions to manage their regulatory capital. This fact has been recognised by the European Union as part of its effort to foster the economic recovery in the aftermath of the COVID-19 crisis.

Legal basis

The basis for the activities of SVI is mainly set by external standards, which are based on the legal framework including the Securitisation Regulation (as amended by Regulation (EU) 2021/558 of 31 March 2021), the CRR (as amended by Regulation (EU) 2021/558 of 31 March 2021), all related regulatory technical standards and implementing technical standards prepared by EBA and ESMA, the guidelines on the STS criteria prepared by EBA and any references in the above-mentioned documents to other EU regulations.

In addition to the legal requirements, SVI is committed to the company's duly Code of Conduct, which ensures the independence and professionalism of the verification process performed by SVI.

On this basis, SVI checks whether the STS requirements are complied with and, within the scope of its verification, identifies any deficiencies in order to give the originator and/or sponsor the opportunity to remedy such deficiencies in accordance with the legal framework.

In the performance of its duties, the management of SVI is committed to the legal framework, the Code of Conduct and its statutory mandate.

Scope of verification

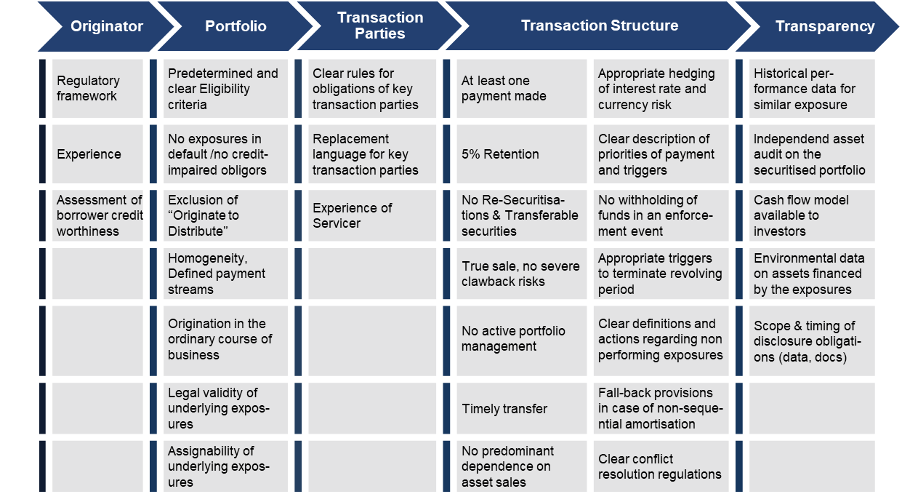

As a third-party verifier authorised and supervised by BaFin, SVI uses a standardised procedure to verify whether securitisations meet the STS criteria laid down in Articles 19 to 22 of the Securitisation Regulation (for non-ABCP securitisations, i.e. term ABS transactions), Articles 23 to 26 (for ABCP securitisations) and Articles 26a to 26e (for synthetic on-balance sheet securitisation), respectively. The verification process is based on a thorough analysis of the transaction under review. Additionally, for the verification of an ABCP Programme, a detailed analysis of the relevant aspects of the sponsor and the programme-level requirements is carried out. All relevant elements of the Securitisation Regulation, the EBA Guidelines and the relevant RTS/ITS form part of the verification. Due to the partial referencing of STS Criteria to those criteria which are valid for all securitisations (e.g. Articles 6 and 7 of the Securitisation Regulation), these are also reviewed to a certain extent. In addition to compliance with transparency requirements, the requirements for the originator, the requirements for the portfolio to be securitised and the requirements for the transaction parties and the transaction structure are also reviewed.

The result of the verification is summarised in an STS verification report, which is made publicly available to the client, investors and other market participants on the SVI website unless privacy requirements preclude this.

The verification process involves the review of transaction-specific and company-related documents and records and includes on-site or virtual due diligence meetings (see ’Required documents’ below).

The verification process is based on the SVI verification manual. It describes the verification process and the individual verifications in detail. The verification manual represents the basis for the verification process, and its application ensures an objective and uniform verification of transactions by SVI across jurisdictions and asset classes.

Documents required

Materials underlying the verification process typically include the documents listed below, although the type, title and scope of the documents may vary significantly depending on the originator/sponsor and the transaction-specific scope of verification. SVI has full discretion as to which of these documents should be requested and considered in a specific transaction. Additional information and/or confirmations may be requested at any time at the sole discretion of SVI.

a) Transaction-specific materials

For traditional securitisations, these include the prospectus and other core legal transaction documents such as:

- Loan Receivables Purchase Agreement

- Servicing Agreement

- Legal opinion(s) confirming the true sale for the relevant jurisdiction(s) involved

- Subordinated Loan Agreement, if any

- Trust Agreement

- Deed of Charge and Assignment

- Note Purchase Agreement

- Agency Agreement

- Account Agreement

- Swap Agreement

- Security Account Agreement

- Data Protection Trust Agreement

- Corporate Services Agreement

For Synthetic Securitisations, the above-listed documents are replaced or complemented with the following documents:

- Financial Guarantee

- Information Memorandum

- Terms & Conditions of the note(s) issued

- Legal Opinion regarding the enforceability of the relevant obligations for the relevant jurisdiction(s) involved

- Legal memo summarising the compliance with, e.g., the requirements for funded/unfunded credit protection and other CRR requirements

- Account Bank Agreement

- Cash Administration Agreement

- Cash Deposit Bank Agreement

- Cash Bank Security Agreement

- Custody Agreement

- Deed of Charge

b) Business-related materials

This information may, for example, cover the following points, which may be requested as deemed necessary:

- Due diligence presentation for arrangers, rating agencies and third party verifier

- Credit & collection policies and other internal materials showing how the credit assessment and monitoring of credit risks is carried out

- Descriptions of the IT programs used in the credit process, access rights and data record structures

- Descriptions of procedures and workflows (e.g. regarding underwriting and servicing)

- Qualification profiles of senior management/senior credit staff;

- Information on the underlying regulatory requirements and competent supervision;

- Loan agreements in use by the originator and description of the preparation/legal review of the loan agreements and general terms and conditions

- Performance data for non-securitised and securitised portfolios

- Portfolio stratification tables

- AuP report prepared by a qualified institution summarising the scope of work and findings of the asset audit in relation to the verification of compliance of the sample with selected eligibility criteria and, where applicable, the accurateness of the loan data disclosed to investors in any formal offering document

- Access to the liability cash flow model according to Article. 22 (3) of the Securitisation Regulation and/or scenario output files

For ABCP Transactions, it is expected that the sponsor makes available to SVI additional information prepared for its own analysis (e.g. due diligence write-ups, extracts from internal credit papers) to the extent practical.

Verification methods

The verification methods described below specify how individual criteria are checked by SVI:

a) REG (regulatory): Existence of regulatory and other legal provisions with recognised supervisory mechanisms (in particular banking supervisory aspects)

If an originator can demonstrate that compliance with a particular criterion is normally ensured due to its regulatory status in a particular country and within the framework of the resulting obligations and verification actions (by banking supervision, external or internal audit), this can be relied upon without further verification actions.

b) LEG (legal): Existence of contractual obligations according to transaction documentation

Many criteria require the originator/sponsor (or service provider or issuer) to include specific representations and warranties, undertakings or other contractual obligations in the transaction documentation. Whether the existence of a representation and warranty, undertaking or other contractual obligation is sufficient or whether (i) a more extensive review of the validity of a representation and warranty, undertaking or other contractual obligation should be carried out on the basis of a legal opinion or (ii) the review of compliance with the contractual obligations at the time of closing should be carried out according to any other verification method is to be decided by management for each individual transaction and each individual criterion and documented in the transaction verification catalogue or verification report, including a brief explanation and justification of the procedure if no legal requirement exists. In addition to the external legal opinion provided by the transaction legal counsel or another law firm, a statement of the originator/sponsor's legal department or the statement of another qualified party may also be considered.

c) DD (Due Diligence): Due Diligence information and actions that can be collected or performed in different ways.

i. WRITTEN EVIDENCE BASED ON DATA AND TABLES, INTERNAL MANUALS AND WORK INSTRUCTIONS, WRITTEN DOCUMENTS SUCH AS DUE DILIGENCE PRESENTATIONS.

Compliance with STS criteria may require, among other things, requesting documents from the originator/sponsor of such documents (e.g. relevant parts of internal manuals, credit & collection policies, work instructions, due diligence presentations or individually prepared data, tables), evaluations or written expert estimates (from senior management or management of specialist departments), reviewing them for the criteria to be verified, and filing them. Instead of the detailed verification of facts, written confirmations from the originator/sponsor can also be used.

ii. VERBAL EVIDENCE BY MANAGEMENT OR RESPONSIBLE SPECIALIST DEPARTMENTS WITHIN THE FRAMEWORK OF DUE DILIGENCE PRESENTATIONS BY THE ORIGINATOR OR INTERVIEWS WITH EXPERTS.

In the same manner, and often in combination with the written evidence as described above, , the verbal presentation and discussion of the information concerned may serve to verify compliance with STS criteria.

In the case of critical issues, written audit opinions or confirmations of the originator/sponsor may be required.

d) DAT (data): Verification on the basis of own data evaluation, to be distinguished into

i. VERIFICATION BASED ON COMPLETE SURVEYS (RELEVANT POPULATION)

In the case of individual criteria, it may be useful to check compliance with them using evaluations of the population (for example, all securitised receivables).

ii. SAMPLING VERIFICATION

As an alternative to the above, the verification of criteria against a randomly selected and statistically significant sample may be appropriate.

Irrespective of the verification method(s) applied, the following type of verification result can be achieved:

a) Yes / No (digital assessment)

b) Hard evidence (100% collection and verification)

c) Statistical evidence (sample based on the required confidence level)

d) Validated evidence (assessment and validation based on verification of internal consistency as well as based on predecessor transactions and market practices)

When preparing the transaction verification catalogue for each individual transaction, management will determine the verification methods a) to d) as described above to be used, taking into account the achievable verification result.

The verification process

Time horizon for implementation

We recommend to involve SVI acting as a third party verifier in an early stage of the deal structuring - ideally directly when the planned transaction is set up or restructured to comply with the STS criteria. SVI’s verification process runs mostly in parallel with the rating and other structuring process, including the drafting of the legal documentation. SVI is fully available for any pre-discussion of potentially critical (from an STS perspective) aspects of a given transaction. Following SVI’s formal engagement and kick-off call to discuss timing and next steps, a time frame of 3-5 weeks should be reserved, in the case of initial verifications, for SVI to perform its analysis and prepare its verification report. The timeline can be shorter for subsequent verifications where SVI has performed an STS verification for a previous transaction of similar structure.

The timeframe is significantly influenced by the availability and quality of the legal documentation and other transaction information provided and the complexity of the transaction.

The results of the verification are summarised in a preliminary STS verification report, which is typically published on the SVI website with the announcement of the transaction. The final STS verification report is then prepared for the closing of the transaction on the basis of the final transaction documentation, which is also made available to market participants on the SVI website.

Overview of the verification process: Verification process STS-Compliance

The individual steps of the verification process in detail

Note: The verification process and the verification steps as shown below are similar for non-ABCP Securitisations, ABCP securitisations (transaction-level) and synthetic securitisations.

- Initiation: SVI sends application form to the originator/sponsor who then returns it, completed with the respective general transaction information, to SVI. Alternatively, SVI can be provided with the relevant key transaction information by email or verbally.

- Mandating: SVI sends a signed engagement offer letter (including SVI general terms and conditions of verification, SVI fee schedule and SVI travel expense guidelines) to the originator/sponsor who then returns the countersigned engagement acceptance letter to SVI.

- Information: The originator/sponsor sends an initial information package (term sheet, transaction timeline, working party list) to SVI.

- Transaction Verification Catalogue: Based on the information derived from the application form and the initial information package, SVI prepares the transaction-specific Transaction Verification Catalogue (setting out the verification steps for the specific transaction based on SVI’s Verification Manual) and forwards it to theoriginator/sponsor.

- Outsourcing by SVI (optional): Assignment of the appropriate outsourcing partner(s).

- Verification Process: SVI and its outsourcing partner(s) implement and document verification actions.

- STS Conformity: In case of non-compliance with selected STS Criteria, interim discussion with the originator/sponsor and possibility for originator/sponsor to rework critical aspects of the transaction. SVI verifies STS Conformity of the amendments and decision regarding fulfilment of the STS Criteria.

- Preliminary Verification Report (optional, typically for public non-ABCP securitisations): SVI prepares Preliminary Verification Report and forwards it to the originator/sponsor; originator, arranger and lead managers use the Preliminary Verification Reportat the time of the announcement of a transaction and during pre-marketing of the transaction for disclosure to potential investors.

- Completion of Verification: Execution and documentation of open verification actions on the basis of the final transaction documentation and the closing of the transaction, final discussion with the originator/sponsor if necessary.

- Final Verification Report: Preparation and completion of the Final Verification Report based on information received from the originator/sponsor and other relevant parties.

- Publication: Depending on the originator/sponsor’s confidentiality requirements, key transaction information and link to the Preliminary/Final Verification Report and other selected deal information (e.g. STS notification, Prospectus) are posted on SVI’s website

- Ongoing (optional): Publication of monthly or quarterly investor reports on the website of SVI.

ADDITIONAL SERVICES

In addition to verifying compliance with the STS criteria pursuant to Articles 18-26e of the Securitisation Regulation, SVI performs the following services (‘Additional Services‘):

- CRR assessments: verification of compliance of securitisations with Article 243 of the Capital Requirements Regulation (Regulation (EU) 2017/2401 dated 12 December 2017, amending Regulation (EU) No 575/2013 on prudential requirements for credit institutions and investment firms) (‘CRR‘)

- LCR assessments: verification of compliance of securitisation positions with Article 13 of Delegated Regulation (EU) 2018/1620 on liquidity coverage requirements for credit institutions dated 13 July 2018, amending Delegated Regulation (EU) 2015/61 to supplement Regulation (EU) No 575/2013 of the European Parliament and the Council with regard to liquidity coverage requirements for Credit Institutions (‘LCR‘)

- Article 270 assessments: verification of compliance of senior positions in synthetic SME securitisations with Article 270 of the Capital Requirements Regulation (Regulation (EU) 2017/2401 dated 12 December 2017, amending Regulation (EU) No 575/2013 on prudential requirements for credit institutions and investment firms) (‘CRR’), as amended by Regulation (EU) 2021/558 of 31 March 2021)

- Gap analyses: verification of compliance of securitisations with the STS criteria, in respect of existing securitisations and potential deficiencies regarding compliance with the STS criteria.

If you need further assistance or information, please get in touch.

Fees

The fee schedule of STS Verification International GmbH (‘SVI’) applies uniformly to all asset classes and jurisdictions, but differs between the transaction types (non-ABCP securitisations, ABCP securitisations and synthetic on-balance sheet securitisations).

The fees are set by SVI to comply with the requirements of Article 28 of Regulation (EU) 2017/2402 (‘Securitisation Regulation’), in particular the requirement for the third party verifier to only charge non-discriminatory and cost-based fees to the originators, sponsors or SSPEs involved in the securitisations which the third party verifier assesses, see Article 28 (1) (a) of the Securitisation Regulation.

Fees for non-ABCP securitisations

The SVI fees for non-ABCP securitisations for initial verifications range from EUR 33,000 to EUR 44,000 plus VAT. To determine the exact fee, a factor of 0.0055% will be applied to the total volume of the transaction on the basis of the tranches issued. No distinction is made if the tranches are rated or unrated, placed or retained. If the fee determined on the basis of the volume is outside the corridor of EUR 33,000 to EUR 44,000, a minimum fee of EUR 33,000 plus VAT or a maximum fee of EUR 44,000 plus VAT is charged. As an alternative to the up-front payment of the fee, an economically equivalent fee with an annual payment method or a combination of upfront and ongoing fee can be agreed.

For subsequent verifications, a discount of 5-20 % on the initial verification fee will be granted. Subsequent verifications are generally defined as transactions that share similar characteristics (e.g. same originator or originator group, same asset class) with the initial verification. The discount must be determined individually and depends on the type and scope of the verification activities, which are mainly determined by deviations in the transaction structure compared with the initial verification or possible on-site inspections (’due diligence’). For subsequent verifications of transactions that have a repeat deal character (in particular an unchanged transaction structure and legal documentation), the discount can be increased up to 25% (where SVI has verified at least two prior transactions) and up to 30% (where SVI has verified at least three prior transactions). The classification as initial or subsequent verification and repeat deal and the setting of the discount shall be made by SVI's management. In case of doubt, the SVI Supervisory Board may be involved.

The publication of the STS Verification Report on the SVI website (www.sts-verification-international.com) is covered by the verification fee.

Fee schedule for non-ABCP securitisations

Fees for ABCP securitisations

The SVI fee for ABCP transactions consists of an initial verification fee and an annual fee. The fee for the initial verification per ABCP transaction is typically within a range of EUR 12,000-20,000 plus VAT. The additional annual fee per ABCP transaction is in the range of EUR 4,000-6,000 plus VAT. Where the nature, scope and structure of an ABCP transaction is equivalent to that of a non-ABCP transaction, it is at the discretion of the SVI to apply the fee schedule of a non-ABCP transaction to an ABCP transaction as well.

The exact fee (for initial verification and annual fee) per ABCP transaction is determined by the management of SVI. In case of doubt the supervisory board of SVI may be involved. The type and scope of the preparatory work by the sponsoring bank, the complexity and volume of the respective ABCP transaction, the number of jurisdictions involved as well as the number of ABCP transactions in the respective ABCP conduit, for which verification is simultaneously sought, are decisive.

The fee for verification on an ABCP programme level is determined by the management of the SVI on a case-by-case basis and specifically for the ABCP programme under consideration ('programme fee') depending on the specifics of the ABCP transactions, the ABCP programme and the ABCP programme sponsor. A prerequisite for the verification of an ABCP programme is the successfully completed or simultaneously assigned verification of the ABCP transactions within the ABCP programme by SVI.

The publication of the STS Verification Report on the SVI website (www.sts-verification-international.com) is covered by the verification fee.

Fee schedule for ABCP securitisation

FEES FOR SYNTHETIC ON-BALANCE SHEET SECURITISATIONS

The SVI fees for synthetic on-balance sheet securitisations for initial verifications range from EUR 38,500 to EUR 46,750 plus VAT, reflecting the somewhat higher complexity in particular of the specifics of synthetic securitisations compared with non-ABCP traditional securitisations. To determine the exact fee, a factor of 0.0055% will be applied to the total transaction volume of the transaction as determined by SVI and based of the reference portfolio and/or the tranches defined, as applicable. No distinction is made if the tranches are rated or unrated, placed or retained. If the fee determined on the basis of the volume is outside the corridor of EUR 38,500toEUR 46,750, a minimum fee of EUR 38,500 plus VAT or a maximum fee of EUR 46,750 plus VAT is charged. As an alternative to the up-front payment of the fee, an economically equivalent fee with an annual payment method or a combination of upfront and ongoing fee can be agreed.

For subsequent verifications, a discount of 5-20% on the initial verification fee will be granted. Subsequent verifications are generally defined as transactions that share similar characteristics (e.g. same originator or originator group, same asset class) with the initial verification. The discount must be determined individually and depends on the type and scope of the verification activities, which are mainly determined by deviations in the transaction structure compared with the initial verification or possible on-site inspections (’due diligence’). For subsequent verifications of transactions that have a repeat deal character (in particular an unchanged transaction structure and legal documentation), the discount can be increased up to 25% (where SVI has verified at least two prior transactions) and up to 30% (where SVI has verified at least three prior transactions). The classification as initial or subsequent verification and repeat deal and the setting of the discount is made by SVI's management. In case of doubt, the SVI Supervisory Board may be involved.

The publication of the STS Verification Report on the SVI website (www.sts-verification-international.com), if desired by the client, is covered by the verification fee.

Fee schedule for synthetic on-balance sheet securitisations

FEES FOR ADDITIONAL SERVICES

The fees charged by SVI for Additional Services are as follows:

Type of Additional Service | Fee Amount |

|---|---|

| CRR Assessment (ABCP) | EUR 2,000 plus VAT |

| CRR Assessment (non-ABCP) | EUR 2,000 plus VAT |

| LCR Assessment | EUR 2,000 plus VAT |

| Article 270 Assessment | EUR 2,000 plus VAT |

| Gap-Analysis | In line with the transaction type (non-ABCP or ABCP), the fee amount will be determined in accordance with the applicable SVI Fee Schedule for non-ABCP securitisations or ABCP securitisations. Depending on the expected scope of work for the gap analysis, SVI may grant discounts or surcharges to these fee amounts |

| Website Publications | EUR 1,500 plus VAT |