About us

SVI at a glance

STS Verification International GmbH (SVI) is a third party authorised by the Federal Financial Supervisory Authority (BaFin), acting as a Competent Authority pursuant to Article 29 of the Securitisation Regulation, to verify compliance of securitisation transactions with Articles 19 to 26e of the Securitisation Regulation. As such, SVI provides independent and objective verification services for eligible securitisation transactions under the European securitisation regulation framework.

The scope of the approval includes all asset classes for all countries of the European Union (EU) for the transaction types ‘non-ABCP securitisations’ (see Articles 19-22 of the Securitisation Regulation), ‘ABCP securitisations’ (on transaction and on programme level, see Articles 23-26 of the Securitisation Regulation) and ‘synthetic on-balance sheet securitisations’ (see Articles 26a-26e of the Securitisation Regulation.

In addition, SVI performs Additional Services including

- CRR assessments

- LCR assessments

- Article 270 assessments and

- gap analyses

More details on these Additional Services

SVI’s business activity is focused on providing, as a third party in accordance with Article 28 of the Securitisation Regulation, neutral verification of the compliance of securitisation transactions with the STS criteriain accordance with Articles 18-26e of the Securitisation Regulation. The purpose of the company is strictly limited to this activity and to the aforementioned additional services, and all bodies of the company are required to comply with the Securitisation Regulation and all related legal acts. This creates a clear and unambiguous framework for SVI to act with integrity and independence. The latter is ensured in particular by an independent management and by the independent members of the company's Supervisory Board.

As part of TSI group, SVI's mission is to contribute to a well-developed, high-quality and sustainable securitisation market in Europe and to facilitate securitisation transactions for originators and investors. With its work, it strives to ensure that best market practices are applied to STS securitisations for the approved transaction types, thereby establishing STS as an accepted market standard for securitisations throughout Europe.

The legal and economic expertise and long-standing experience of SVI‘s senior management and staff and its outsourcing partners ensure an accurate, efficient and transparent verification process.

STS Verification International GmbH is a 100% subsidiary of True Sale International GmbH (TSI), an industry body established in 2004 to foster the development of securitisation in the German and European market. Against the background of the legal framework (Securitisation Regulation and the supplementary Regulatory Technical Standards of ESMA on third party verification), SVI‘s governance is structured to ensure the greatest possible independence.

Please refer to the Presentation “Update on STS and related Securitisation topics” for more background on SVI and its track record, the STS verification process and current market developments.

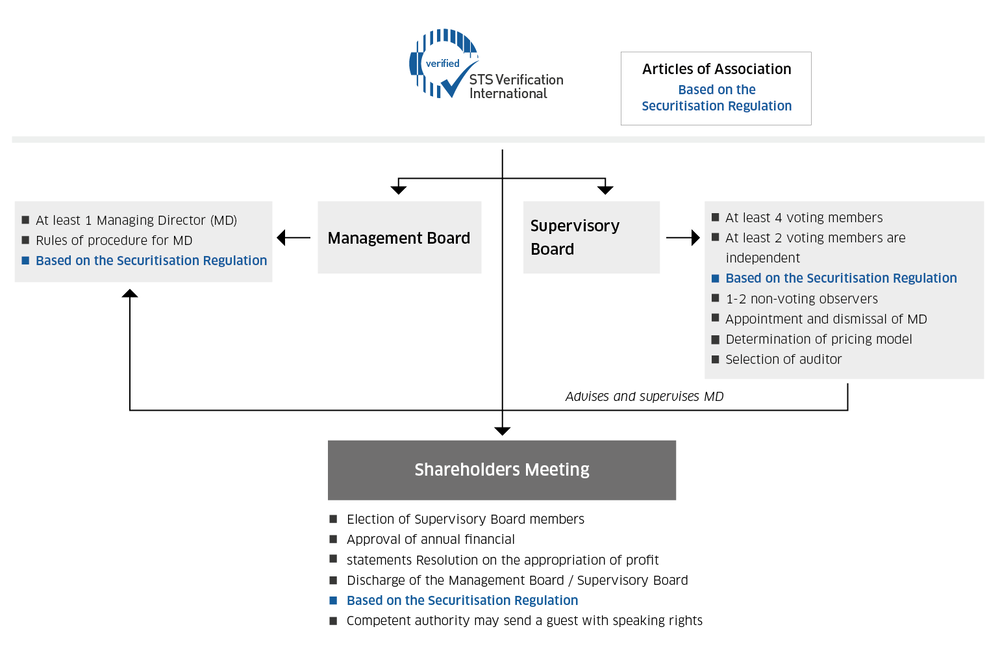

Structure and Organisation

The sole shareholder of SVI is True Sale International GmbH. However, the Articles of Association of SVI ensure that all material decisions fall under the responsibility of the Supervisory Board. These include

- the appointment and supervision of SVI’s senior management,

- questions concerning the business plan and the fee schedule,

- all questions concerning the verification of STS transactions (insofar as they are not the direct responsibility of SVI’s senior management),

- the annual review of the verification process, etc.

SVI‘s Articles of Association were part of the approval process conducted by the competent authority pursuant to Article 29 of the Securitisation Regulation (in the case of SVI, this is the Federal Financial Supervisory Authority (Bafin) and therefore guarantee the independence of SVI.

Other organisational measures that have been taken to ensure compliance with supervisory requirements:

- At least half of the Supervisory Board members are independent members within the meaning of the Securitisation Regulation and the related delegated acts.

- The Chair of the Supervisory Board and his/her deputy are independent members. The Chair of the Supervisory Board has a double voting right in the event of a tie, which means that the independent members cannot be outvoted by the company representatives on the Supervisory Board.

- No member of the Supervisory Board is personally associated with clients of SVI via board or advisory functions. Likewise, the rules of procedure of the Supervisory Board prohibit all members of the Supervisory Board from directly or indirectly holding securitisation positions in transactions that have been verified by SVI.

- The verification process and the verification result are the responsibility of the Managing Director of SVI. The Supervisory Board can establish a verification committee of at least two persons, which can be consulted for interpretation purposes. The vote of the verification committee is not binding on the management but cannot be deviated without good and clearly documented reasons.

- The management must conduct an annual review of the verifications carried out, which is provided to the Supervisory Board for information and further discussion. The review focuses on any conflicts of interest and experiences with individual verifications carried out during the review period as well as any changes in the legal framework and market developments that were of significance for the verification business.

- All modifications and changes to SVI‘s verification process, its verification manual and other relevant procedures must be approved by the Supervisory Board.

These measures contribute to the independence of SVI and its management and ensure that the conduct of the company and its employees are in compliance with the securitisation framework. At the same time, they make sure that the management and employees of SVI apply the relevant procedures accordingly vis-à-vis its clients, the regulators and other market participants.

The team

Michael Osswald

Managing Director

Michael Osswald has been the Managing Director at STS Verification International GmbH since February 2019. He is responsible for all operational and strategic aspects of the company. Michael has extensive securitisation experience both on the investment side and in the origination and structuring of Term ABS and ABCP transactions, which he gained from 1998 at Landesbank Baden-Württemberg and from 2001 at ABN AMRO Bank as part of the European securitisation team. In 2009, Michael moved to the asset-based lending/ship financing division at KfW IPEX-Bank and was responsible for the sub-portfolios asset securitisation, infrastructure, aviation and shipping in Credit Risk Management at Erste Abwicklungsanstalt. Michael holds a degree in business administration from Julius Maximilian University of Würzburg.

Tel: +49 69 8740 344-10

E-mail: michael.osswald@svi-gmbh.com

Carlo Barbarisi

Senior Advisor

Carlo Barbarisi joined STS Verification International GmbH in May 2024 as Senior Advisor and he is primarily involved in business development across Europe. He brings in over thirty years of diversified international experience in credit and capital markets, mainly rooted within the rating agencies industry (S&P Global Ratings, FitchRatings, CRIF Ratings) and the commercial banking sector (UniCredit Group, BPER Group) at managerial and strategic levels. Carlo is also serving as independent non-executive director and as university lecturer at various educational institutions.

Carlo holds a Degree with full marks in Economics from Università Bocconi of Milan.

Mobile: +49 170 670 40 36

E-mail: carlo.barbarisi@svi-gmbh.com

Marco Pause

Director

Marco Pause has been a Director of STS Verification International GmbH since September 2019. He is responsible for the preparation and implementation of STS verifications of all kinds. Marco joined the Credit & Securitisation Advisory Team at the auditing company Deloitte in Düsseldorf in 2005, where he gained securitisation experience over many yearson.

In his position as Senior Manager he was primarily responsible for the execution of numerous due diligences at German automotive and consumer banks as well as banks with mortgage portfolios in the context of securitisation and portfolio transactions. Marco was involved in a multi-year project where he directed the organisation and implementation of the project management of a state guarantee for a German Landesbank in connection with credit and solvency checks of individual exposures in the Shipping, Corporate Clients and Aviation segments.

Marco holds a degree in Business Administration from Georg August University in Göttingen.

Tel: +49 69 8740 344-43

E-mail: marco.pause@svi-gmbh.com

Salah Maklada

Director

Salah has been a Director of STS Verification International GmbH since March 2023. He joined the STS Verification International GmbH team in July 2021, bringing in 10 years of securitisation experience gained through his work in the Credit and Securitisation team of Deloitte.

His responsibilities at Deloitte covered trustee and verification services for a wide range of clients in Germany (originators, investors and sponsors) in various synthetic and true sale transactions.

As a Senior Manager at Deloitte he was mainly responsible, as the lead manager, for the performance of agreed-upon procedures and credit file due diligences at banks in the context of securitisation and portfolio transactions for consumer, auto and mortgage loans. Salah was also responsible for the performance of several asset audits at medium-sized businesses with regards to trade receivables securitised in ABCP transactions.

Salah holds a degree (Diploma) in Business Administration from the University of Cologne.

Tel: +49 (0)69 8740 344-45

E-mail: salah.maklada@svi-gmbh.com

Mario Maria Venosa

Associate Director

Mario Maria Venosa has been an Associate Director of STS Verification International GmbH since March 2024. He joined the STS Verification International GmbH team in September 2023. He has developed his experience with securitisation transactions during his years in Intesa Sanpaolo where he had the role of Senior Specialist within the Credit Portfolio Division from 2019 to 2023. He had the chance to develop a wide knowledge of securitisations, with a particular focus on Synthetic transactions. Mario Maria Venosa has a Bachelor Degree in Business Administration at Università Commerciale Luigi Bocconi, a Master Degree in Banking and Finance at Università Cattolica del Sacro Cuore in Milan and a Master of Arts in European Economic Governance.at LUISS University in Rome.

Tel: +49 69 8740 344-42

E-mail: mario.venosa@svi-gmbh.com

Dr Michael Weller

Chairman of the Supervisory Board

Michael Weller is chairman of the supervisory board of STS Verification International GmbH.

He is Retired Partner of Clifford Chance where he worked for nearly 25 years in various roles, in particular in banking & capital markets and more particular in the securitisation field. Also, he is an alumnus of Deutsche Bank (1985-1992 inhouse counsel), Institute for Law and Finance (ILF) of Goethe Universität, Frankfurt (2002 - 2020 lecturer) and EBS Universität für Wirtschaft und Recht, Wiesbaden (2018 – 2022 full professor).

Since its inception Michael is a member of the Verbriefungsforum of TSI. Quote of a Rechtsanwalt in this market: „He advised a broad range of transaction participants since the beginning of securitisation in Germany and has contributed from such beginning to shaping the product“.

Tel: +49 69 8740 344-40

E-mail: michael.weller@svi-gmbh.com

Prof Dr Arnd Verleger

Deputy Chairman of the Supervisory Board

Dr Arnd Verleger has been the Chief Risk Officer of HEP Kapitalverwaltung AG, Güglingen, since 2019. Prior to that, he spent over 25 years in the banking business, most recently as the CFO of Santander Consumer Bank AG, Mönchengladbach, and Bank für Sozialwirtschaft AG, Cologne. During that time Arnd accompanied numerous securitisation transactions as an arranger and originator. He also works as a university lecturer at various educational institutions, in particular at the Hochschule für Ökonomie & Management in Essen and the Hochschule Niederrhein in Mönchengladbach. Arnd studied business administration at the Westfaelische Wilhelms-Universität in Münster (Diplomkaufmann) and subsequently worked there as a research assistant and received his doctorate in political sciences.

Tel: +49 69 8740 344-50

E-mail: arnd.verleger@svi-gmbh.com

Jan-Peter Hülbert

Member of the Supervisory Board

Jan-Peter Hülbert has been Managing Director of True Sale International GmbH since July 2018. He brings over 20 years of experience in the banking and capital markets business, including 16 years in securitisation on the banking side. Jan-Peter has been responsible for client transactions for banks, corporates and leasing companies in the public ABS, private securitisation and ABCP segments. He holds a degree in business administration from LMU Munich and is a member of the Supervisory Board of STS Verification International GmbH and of the Supervisory Board of European DataWarehouse GmbH.

Tel: +49 69 2992-1730

E-mail: jan-peter.huelbert@tsi-gmbh.de

Mario Uhrmacher

Member of the Supervisory Board

Mario Uhrmacher has been working for True Sale International GmbH since 2007. He has been actively involved in setting up the certification label DEUTSCHER VERBRIEFUNGSSTANDARD and has carried out over 100 certifications of high-quality securitisation transactions. As the Managing Director of TSI Services GmbH, Mario is also responsible for the establishment and liquidation of German special-purpose entities for securitisation transactions. In addition, he is actively involved in the STS verification work for SVI through an outsourcing agreement between SVI and TSI. Prior to that, Mario worked in the banking business for many years, most recently as Head of Shared Services Controlling at SEB AG in Frankfurt.

Tel: +49 69 82992-1721

E-mail: mario.uhrmacher@tsi-gmbh.de